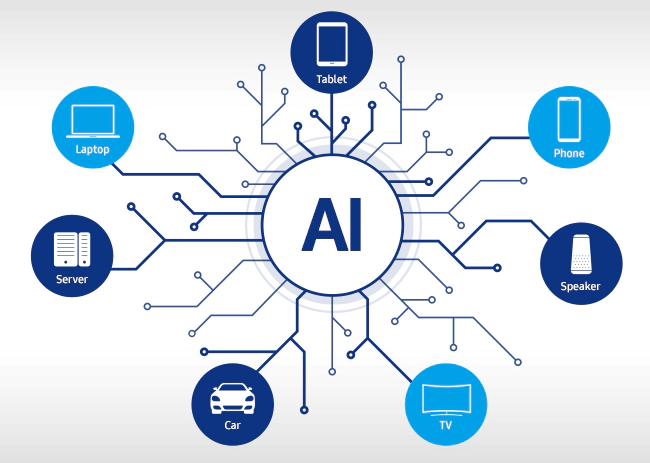

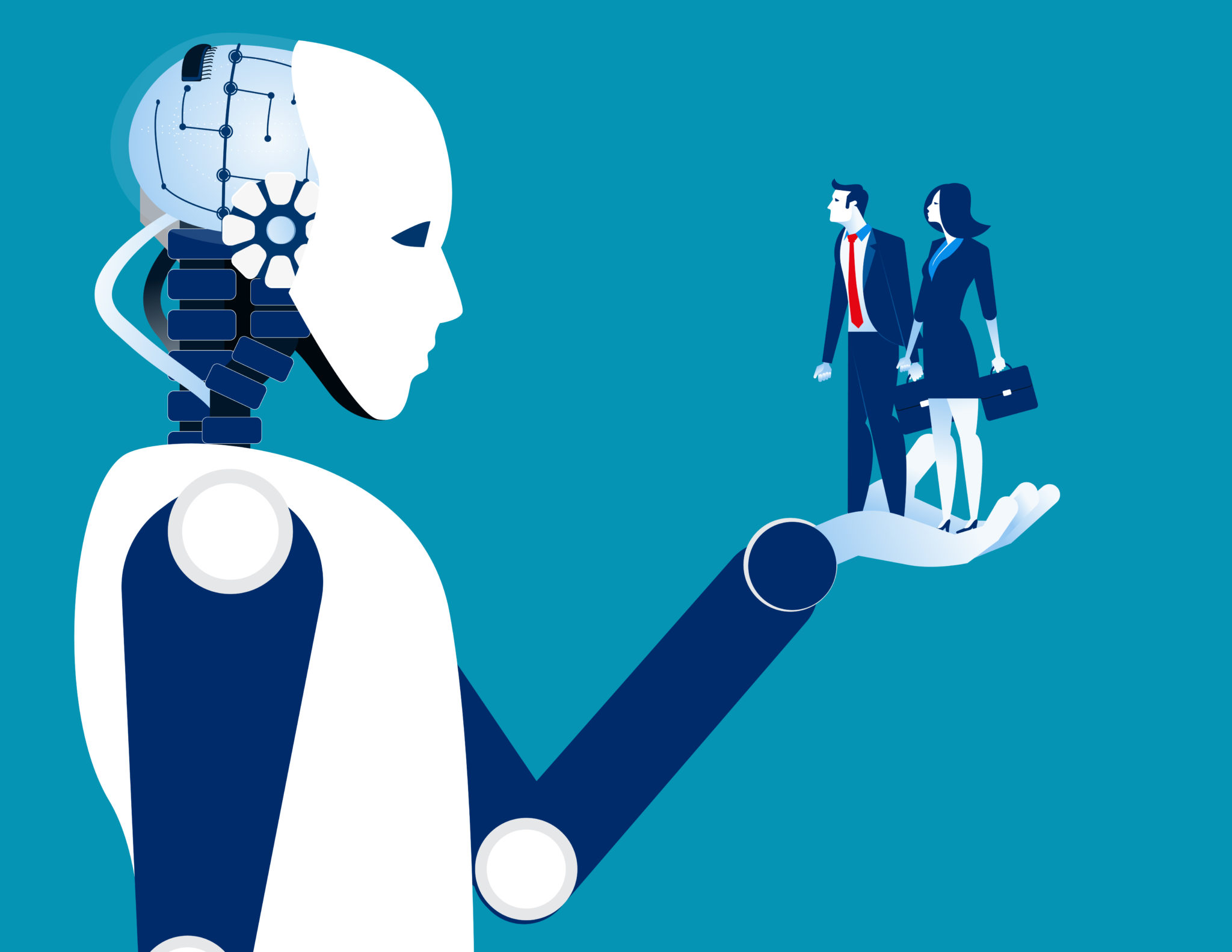

The integration of artificial intelligence (AI) in personal finance marks a revolutionary shift in how we manage our money. Traditional budgeting methods often rely on manual tracking and analysis, which can be time-consuming and prone to human error. AI, however, introduces a level of automation and precision that was previously unattainable. Machine learning algorithms can analyze spending patterns, categorize transactions, and even predict future expenses with remarkable accuracy. This enables individuals to have a clearer understanding of their financial health and make more informed decisions. AI-driven budgeting tools also provide personalized insights, alerting users about unusual spending, forecasting monthly expenses, and offering tips to optimize savings. This level of customization is not just convenient but also empowers users to take control of their finances in a more efficient and effective manner.

Enhancing Financial Literacy Through AI

Artificial intelligence plays a crucial role in enhancing financial literacy, particularly among those who may find traditional financial management overwhelming or inaccessible. AI-powered apps and tools demystify financial concepts by providing users with easy-to-understand insights and actionable advice. For instance, AI can help identify areas where an individual may be overspending and suggest budget adjustments or smarter spending habits. Moreover, these tools often include educational content tailored to the user’s financial situation, thereby offering a learning experience that evolves with their financial journey. This personalized approach to financial education is not only more engaging but also more likely to result in lasting financial behavior change. By simplifying complex financial data and providing relevant learning resources, AI helps users build a stronger foundation in personal finance.

Predictive Analysis for Proactive Financial Planning

One of the most significant advantages of AI in personal finance is its ability to perform predictive analysis. This involves using historical financial data to forecast future trends and potential scenarios. For instance, AI can analyze spending habits and income fluctuations to predict cash flow issues before they occur, allowing users to adjust their budgets proactively. This predictive capability extends to goal setting and savings strategies. AI can suggest realistic savings goals based on an individual’s income and expenditure, and even adjust these goals dynamically in response to changes in their financial situation. Furthermore, AI can predict how market changes might impact investments, helping users to make more informed decisions about their portfolios. This proactive approach to financial planning, made possible by AI, can significantly reduce financial stress and improve financial outcomes.

The Role of AI in Debt Management and Reduction

Debt management is another area where AI is making a substantial impact. AI tools can analyze an individual’s debt profile, including credit card balances, loans, and mortgages, and then devise optimized repayment strategies. For example, these tools can recommend the most effective debt repayment plan, whether it’s the snowball method (paying off smaller debts first) or the avalanche method (targeting debts with the highest interest rates). AI can also monitor interest rates and suggest the best times to refinance or consolidate debts. Moreover, AI-driven reminders and notifications help ensure timely payments, thereby improving credit scores. By providing personalized and strategic debt management solutions, AI is an invaluable ally in the journey towards financial freedom.

Security and Privacy in AI-Driven Personal Finance

As AI becomes more integrated into personal finance, concerns around security and privacy have gained prominence. It’s crucial that AI systems handling sensitive financial data are built with robust security measures. This includes encryption, secure data storage, and regular audits to prevent data breaches. Additionally, AI-driven financial tools must comply with privacy regulations, ensuring that user data is collected, stored, and used ethically and legally. Users should also be educated about best practices for safeguarding their personal information while using these tools. Despite these challenges, the potential benefits of AI in personal finance are immense, provided that security and privacy are prioritized and maintained.

Leave a Reply